Food Businesses and Employment

Local farms and food processing are an important component of our economy. According to the 2013 Thunder Bay Multiplier Study, “many jobs were lost in Ontario as a result of the economic depression since 2008. However, food production-related employment has been more or less stable as compared to other industries.” 29 The food processing and farming businesses also generate the highest annual revenue in Ontario and provide a significant number of both direct and indirect jobs. 30

Local Food Distribution & Access

Despite its value to the local economy, by and large, our food supply chain is not designed to accommodate local food and Thunder Bay’s food infrastructure reflects this. The great majority of the food consumed in Thunder Bay is produced elsewhere and trucked or flown in. Food tends to be aggregated by grocery chains and national food wholesalers in centres to the west of us like Winnipeg or Calgary before being shipped here for final delivery to grocery chains, local retailers, public sector institutions and restaurants. Some food is imported from the United States and southern Ontario via the Toronto Food Terminal. 31

With the exception of dairy farmers, who work within a national supply management system, most of Thunder Bay’s primary producers and harvesters operate on a small scale with no access to commercial infrastructure. Most local food is sold directly to consumers or, in a few cases, to restaurants, local retailers and public sector institutions.

Before the COVID pandemic, local restaurants and farmers’ markets were key marketing channels; however, two years of disruptions to businesses and changes in consumer habits have resulted in some loss of momentum. Some producers have pursued new relationships with locally-owned grocery and specialty food retailers to maintain their sales. This has, in some cases, resulted in them withdrawing from the use of shared marketing infrastructure like farmer’s markets.

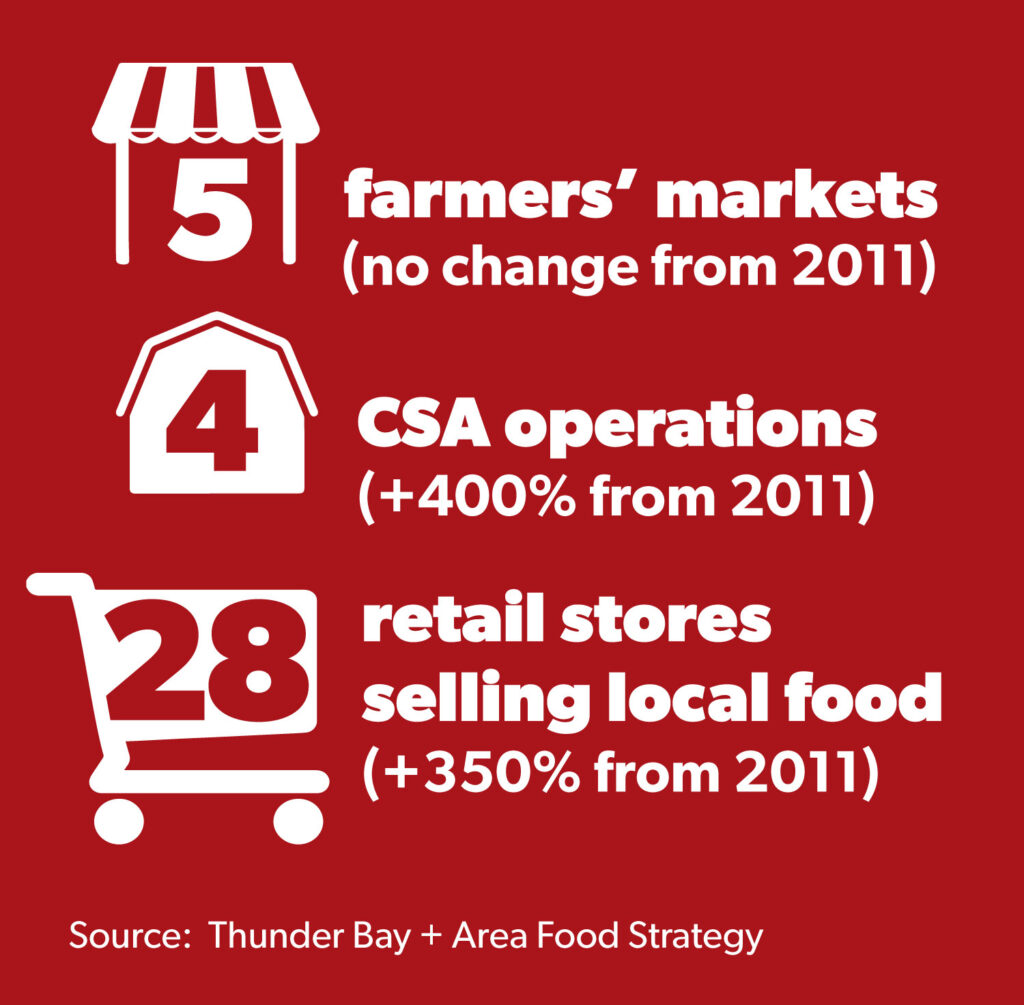

The number of online ordering platforms for local food has increased, with more farms vending through their own websites, often promoting themselves through social media platforms. Web platforms are also being used to improve Community-Supported Agriculture (CSA) consumer experiences. CSA is a subscription model under which patrons pay farmers a set fee for a regular delivery of farm products through the subscription period. These new online systems automate sales and payments and let patrons customize orders before each pickup, which helps producers create efficiencies and increase margin. Thunder Bay’s first CSA farm reported in 2011; in 2021, four farms reported income from the CSA model. 32

A need was identified in the 2015 Report Card for more neighbourhood-level infrastructure, such as small-scale markets, that would make local food more accessible to communities, particularly low-income communities. Recent efforts between front-line organizations and health agencies are making progress on this, which can be seen in the development of new Community Food Markets and the related Market Greens Rx program and an increase in the number of people subscribing to the Good Food Box program. Learn more about these indicators under the Food Access pillar.

Local Food Processing & Storage

Some processing businesses are also essential points of food inspection. Without them, local producers cannot bring their products to market. For example, in Ontario, all raw milk is sold into and must be purchased from the supply management system by a licensed dairy plant and pasteurized before it can be consumed. All meat and poultry must pass through inspection immediately before and after slaughter, while eggs must be graded and inspected before they can be sold anywhere other than at the farm gate by the producer. The successful operation of these essential businesses is vulnerable to shortages of skilled labour, market fluctuations and, in some cases, increasing cost and administrative overhead generated by health and safety, animal welfare and traceability initiatives. Producers’ access to the market depends on their ability to access these businesses.

In addition to one dairy processing facility which engages with the supply management system through traditional channels, Thunder Bay supports one small dairy processor producing fluid milk and a variety of other dairy products, and another processor making cheese. These two operations are able to purchase milk from their own family farms through the supply management system. A third operation uses milk from the dairy system to produce frozen dairy products. There is also a processor producing sheep cheese, which is not governed by the dairy supply management system, from its own milking flock. 33

Most of Thunder Bay’s livestock farmers depend on one local Provincially-inspected slaughter facility which processes beef, pork, lamb, goat and rabbit and offers basic cutting and wrapping services. 34 Poultry processing is not available in Thunder Bay. The local abattoir serves farmers year-round, but its capacity has been challenged by the increasing number of seasonal operators seeking slaughter services in the fall and early winter. Seasonal overflow tends to be borne by the abattoirs in Oxdrift and Rainy River, which also offer poultry processing services.

Further-processing services for local meats including curing, smoking and sausage-making are available through ten businesses in Thunder Bay. 35 One egg-grading station operates in Thunder Bay. Owing to the lack of egg quota in this area, the largest flock in the Thunder Bay area is 500 hens 36, with other egg producers limited by supply management regulations to a maximum of 99 laying hens. The egg grading station services two egg producers year-round, with two or three additional seasonal customers. 37

Outside of the infrastructure for these regulated services, most of the post-harvest packing, processing and storage facilities used by Thunder Bay’s primary producers are located on their farms. Owing to the small scale of many operations, the amount of on-farm infrastructure is limited and tends to be held by year-round operations in higher revenue brackets.

There is one farming operation in Thunder Bay which operates a grain mill, 38 producing several kinds of flour from grain grown on the farm as well as value-added products like baking mixes. This business also operates an oil press 39 and produces canola oil from locally-grown canola seed.

In addition to producer-related infrastructure, there are other processor businesses establishing themselves in the market. Thunder Bay’s further-processors include bakeries, pasta and pasta sauce makers, condiment makers, coffee roasters, tea companies, meat processors and confectioners, among others. Some of these, like the condiment maker which now has products for sale all over North America, deliberately make contracts with local farmers to grow ingredients. Others purchase locally on an as-needed basis. Some processors are working with products which cannot be grown here; others choose not to use local products.

Many of the businesses doing value-added processing are small – generally ranging from part-time businesses to up to 20 full-time staff – but these businesses are thriving and there is potential for future growth and for new businesses to emerge and fill gaps in the market. There is also a need to inventory the diversity of businesses doing value-added processing so that the sector can better be tracked, understood and supported.

As of 2022, there are no commercial fish processing operations in the Thunder Bay area, although there is a home-based fish processing business in operation which works with local and regional fishers.

Farm Inputs

Primary producers rely on a number of inputs, including things like diesel, equipment, installation and repair services, fencing, construction materials, feed, seed and fertilizer. Although some of these inputs are widely available, some are specific to the agricultural sector and are supplied by specialty agricultural businesses. For example, Thunder Bay is home to at least 6 feed stores 40, including a farmers’ cooperative which also supplies other agricultural inputs.

Farm inputs are supported by a variety of infrastructure. For example, suppliers may repack bulk orders, blend ingredients together, and store products in bulk until they are purchased. Larger farm operations often have on-farm versions of this infrastructure, particularly bulk storage set aside on-farm for diesel, feed, seed and fertilizer, while smaller operations tend to rely on supplier infrastructure to ensure products are available when needed.

Much of the infrastructure that supplies local processors has been developed as a result of the demand from local dairy farmers. The buying power of the dairy sector lets farm suppliers buy at preferred prices and helps to defray shipping costs, resulting in savings for all farmers. Destabilization of the dairy industry could have unintended consequences for farm suppliers, with cascading effects for the smaller operators who depend on them.

The infrastructure which supports, and is in turn supported by, primary producers is a complex web which is vulnerable to shortages of skilled labour, market fluctuations and changes to government policy as well as challenges like planning for business succession. There are still large holes in Thunder Bay’s food processing infrastructure, including, for instance, local services for processing poultry. One reason for this is that demand and supply both need to grow to a point where volumes justify the investment in new facilities and equipment.

Food Waste Diversion

An equitable and sustainable food system requires that waste is treated as a resource to be recycled back into agricultural production. National studies indicate that a lot of waste is generated across the food chain—from farm production, distribution and retail to consumption. More than 11.2 million metric tonnes or $49.46 billion worth of food is wasted every year in Canada. 41 Food manufacturing and processing is responsible for as much as 47% of the food wasted across the country. 24% of food waste happens on-farm. 14% of food waste is produced by individuals. Hotels, restaurants and institutions (HRI) are responsible for 9%, retailers 4% and the rest is lost at distribution facilities, food terminals, or during transportation. 42

Some Thunder Bay institutions, businesses, and individuals are diverting food waste; however, efforts are not coordinated or systemic and the amount diverted is a fraction of the overall amount of waste generated. There is an enormous opportunity to ramp up food waste management. By 2025, Thunder Bay will be instituting a curbside organic waste collection program to help divert 50% of household organic waste from the landfill. This is only a starting point to address household waste diversion. Waste streams at all levels of the value chain can be analyzed and tactics for strategic diversion can be implemented and coordinated among value chain participants.